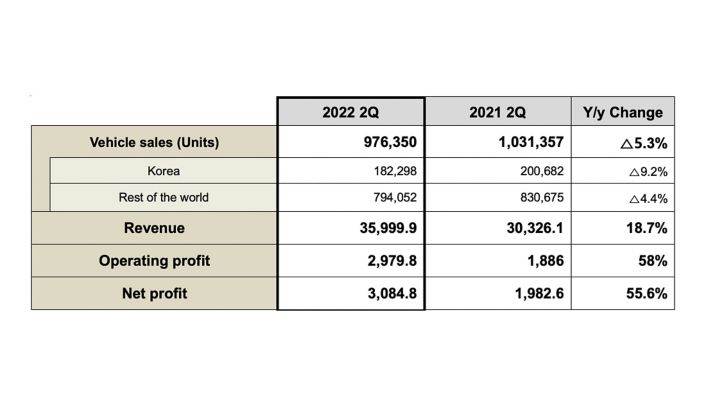

- Q2 revenue increased 18.7% Y/y to KRW 36 trillion

- Operating profit up 58% to KRW 2.98 trillion

- Net profit (including minority interest) rose 55.6% to KRW 3.08 trillion

- The company sold 976,350 units in Q2, down 5.3% from the previous year, affected by chip supply shortages and lockdowns in some Chinese regions

- Improved mix from higher sales of Genesis luxury models and SUVs along with a favorable currency environment helped lift the operating profit margin to 8.3%

- Hyundai’s Q2 full-electric model sales jumped 49% year on year to 53,126 units

- The company expects uncertain business environment to continue from the second half onward amid raw material price fluctuations and COVID-19 resurgence

- Hyundai Motor is striving to maintain profitability with optimized production-sales processes

Press material

-

Download

-

Images

Hyundai Motor Company today announced its business results for the second quarter of 2022. The revenue and operating profit from April to June rose 18.7 percent and 58 percent year-over-year to KRW 36 trillion and 2.98 trillion, respectively.

During the three-month period, Hyundai Motor posted operating profit margin of 8.3 percent, and net profit, including non-controlling interest, increased 55.6 percent to KRW 3.08 trillion.

Hyundai sold 976,350 units around the globe in the second quarter, a 5.3 percent decrease from the year earlier. Sales in markets outside of Korea were down by 4.4 percent to 794,052 units, and sales in Korea decreased 9.2 percent to 182,298 units. The decrease in sales volume mainly stemmed from the ongoing global chip and component shortage and geopolitical issues.

A robust sales mix of SUV and Genesis luxury models, reduced incentives from a lower level of inventory, and a favorable foreign exchange environment helped lift revenue in the second quarter, despite the slowdown in sales volume amid an adverse economic environment.

Hyundai’s EV model sales surged 49 percent from a year earlier to 53,126 units in the second quarter, accounting for 5.4 percent of its total sales volume.

The company maintains its financial guidance that was set in January for 13~14 percent of consolidated revenue growth and 5.5~6.5 percent annual consolidated operating profit margin.

Hyundai Motor’s board today approved a plan to pay an interim dividend of KRW 1,000 per common share.

Hyundai to optimize business operations with electrification leadership around the world

Hyundai Motor expects a gradual recovery from the global chip and component shortage. However, the company also anticipates external uncertainties to continue, including the supply chain disruption caused by the resurgence of a COVID-19 variant and fluctuation in raw material costs due to geopolitical issues.

In addition, the company expects currency rate volatility as well as increasing marketing costs due to fiercer competition among automakers as a burden for the rest of this year.

In order to cope with the uncertainties, the company will focus on the recovery of sales through an optimized production-sales plan in global operations that will enhance its product mix with SUVs and luxury models to secure robust profitability.

In addition, Hyundai will continue to strengthen its global leadership position in electric vehicles with its new IONIQ 6 battery electric vehicle, which will launch in the third quarter.

(Revenue / Operating Profit / Net Profit unit: Billion KRW)

* Sales results are based on wholesale.

* Net Profit includes non-controlling interest

* Under K-IFRS