- Hyundai Motor CEO Jaehoon Chang unveiled the company’s electrification roadmap and strategies at the 2022 CEO Investor Day forum today

- Hyundai targets to sell 1.87 million BEVs annually by 2030 by strengthening line-up

- To introduce 17 new BEV models by 2030; 11 for Hyundai models and six for Genesis luxury brand

- To boost BEV production capability centered on high-demand regions

- Company is considering adding a new dedicated BEV production facility

- To maximize efficiency of lithium-ion batteries; to develop technologies for next-generation batteries as part of company’s comprehensive battery strategy

- To strengthen competitiveness in BEVs through hardware and software capabilities

- To introduce an Integrated Modular Architecture (IMA) in 2025

- KRW 12 trillion earmarked to boost software competitiveness in areas such as connectivity and autonomous driving

- Hyundai expects to invest a total of KRW 95.5 trillion in future business by 2030

- To spend KRW 19.4 trillion on electrification

- The company targets 10% or higher operating profit margin in BEVs; On a consolidate-basis, company aims to achieve 10% of operating profit margin

- To pursue sustainable progress by enhancing hardware and software competitiveness in EVs, said CEO Chang

Press material

-

Download

-

Images

Hyundai Motor Company today unveiled a strategic roadmap to accelerate its electrification ambition as it pursues sustainable progress for the company.

President and CEO Jaehoon Chang and other executives presented the plans to shareholders and investors, and other various stakeholders at the ‘2022 CEO Investor Day’ virtual forum. The company also unveiled targets for sales and financial performance to be achieved by 2030.

The roadmap for Hyundai’s battery electric vehicle (BEV) is supported by: strengthening BEV line-ups, optimizing manufacturing capacity, and securing hardware and software competitiveness. Under the plan, the company aims to boost annual global BEV sales to 1.87 million units and secure a 7 percent level of global market share by 2030.

Hyundai also presented its mid-to long-term financial goals. The company earmarked KRW 95.5 trillion of investment for future businesses by 2030, including KRW 19.4 trillion for electrification and KRW 12 trillion for software capabilities.

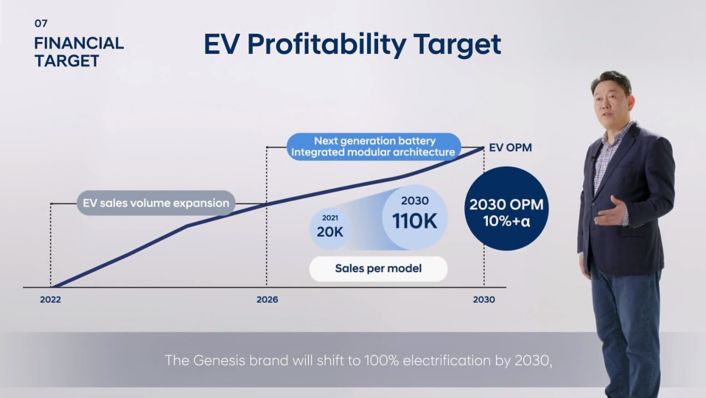

By 2030, Hyundai also targets to achieve an operating profit margin of 10 percent or higher in EV businesses by enhancing competitiveness in hardware and software capabilities with an expanded line-up. On a consolidated basis, it aims to secure an operating profit margin of 10 percent.

Hyundai is successfully accelerating its transition to electrification and becoming a global leader in EVs despite a challenging business environment caused by the global chip shortage and ongoing pandemic. Along with our seamless efforts to improve EV value, Hyundai Motor will continue to secure its business sustainability as a ‘Mobility Solutions Provider’ through advanced technologies of not only hardware but also software.

Strengthening BEV line-ups

Hyundai Motor raised the annual BEV sales target to 1.87 million units by 2030 from previously announced 560,000 units by 2025. The company aims to take 7 percent market share in the overall global BEV market.

Hyundai plans to introduce 17 BEV models; 11 Hyundai marque models along with six models from Genesis luxury brand by 2030 as it seeks to expand BEV spectrum.

The new Hyundai BEV models will include three sedan models, six SUVs, one light commercial vehicle as well as one new type model. This year, Hyundai begin sales of IONIQ 6, followed by IONIQ 7 in 2024.

Genesis luxury brand, the BEV line-up consists of two passenger cars and four SUVs, including the Electrified GV70 launching this year. Starting in 2025, all newly launched models from Genesis will be electrified.

Presentation scene of Jaehoon Chang, President and CEO of Hyundai Motor Company

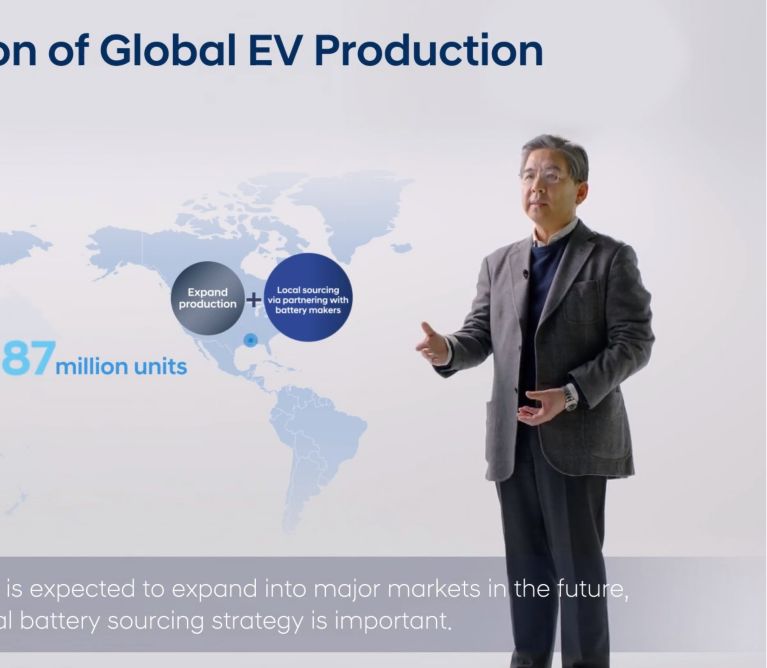

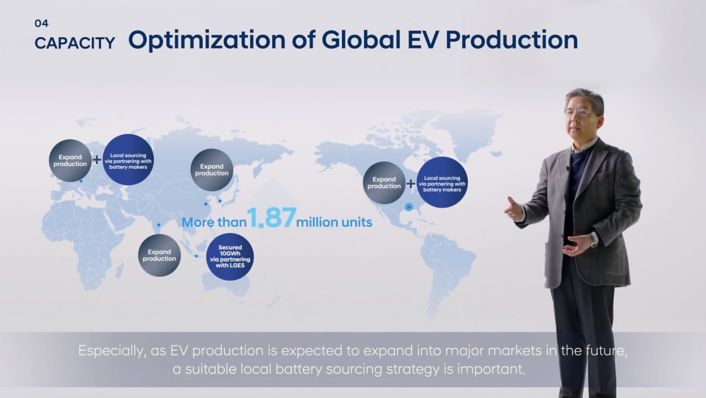

Optimizing EV Manufacturing Capacity

Hyundai Motor aims to establish a high efficiency manufacturing process for BEV production to accelerate its transition into electrification. Hyundai Motor Global Innovation Center in Singapore (HMGICS), the cornerstone for innovation in the company’s mobility value chain, will build a human-centered manufacturing innovation platform. The platform is expected to bring dramatic innovation in production efficiency through a flexible production system, advanced level automation and digital twin technology. The innovation will be expanded to global plants in the future.

Beyond existing BEV production facilities centered in Korea and the Czech Republic, Hyundai plans to gradually expand its BEV manufacturing bases, starting with an Indonesian plant that recently started operation. The Indonesian plant will start BEV production this year to help expand production volume.

As BEV production bases expand, the company is trying to increase the local procurement rate of batteries through strategic alliances with battery companies in major regions, including the U.S., to secure sufficient battery supply. Through these alliances, the company expects to obtain more than 50 percent of its next-generation lithium batteries for BEVs starting in 2025.

In addition, Hyundai will also diversify battery sourcing to consolidate the competitiveness of future BEVs. The company has secured sufficient battery supply to meet its sales targets by 2023. Hyundai plans to continue cooperation with various battery companies with an aim of securing 170 GWh of batteries for its models, including Genesis luxury brand by 2030.

Regarding the next-generation batteries, such as solid-state battery, Hyundai is cooperating with various global partners to improve energy density and cost efficiency.

Securing Hardware and Software Competitiveness

Hyundai Motor plans to introduce an Integrated Modular Architecture (IMA), evolved from the electric global modular platform (E-GMP) that is the foundation of IONIQ 5 and GV60, successfully launched in 2021. The IMA will be utilized not only to as Hyundai Motor’s passenger BEV platform but also as its exclusive purpose-built vehicle (PBV) platform, helping to streamline production processes and reduce cost.

The IMA is being developed to standardize not only a chassis but also battery system and motor. The innovative architecture can be used for BEV models in all segments, improving driving range.

Unlike the existing BEV development system, which has different types of battery packs for each model, IMA can be equipped with standardized battery packs to attach flexibly regardless of the model to improve cost efficiency. Through the cell-to-pack system, the new architecture can secure sufficient energy density and shorten charging time.

Standardized five type of motors also will be installed on IMA according to model needs. This modular motor system can secure competitiveness in terms of cost and weight as well as motor efficiency.

Hyundai Motor will also strive to develop software architectures to provide a satisfying ownership experience for customers. The company plans to apply an over-the-air (OTA) update to new models that will be launched starting at the end of 2022, and expand it to all Hyundai models by 2025. In addition, the number of integrated control units can be reduced by one-third by 2030.

In terms of autonomous driving technology, the Highway Driving Pilot (HDP), a Level 3 autonomous driving function, will be applied to Genesis G90 starting in the second half of this year. The Motional, the autonomous driving joint venture between Hyundai Motor Group and Aptiv, plans to expand the service area of an IONIQ 5-based robotaxi following its commercial service commencement in 2023 and start self-driving delivery services this year through partnerships with Uber Eats.

Hyundai will achieve software transformation by expanding the business areas of mobility, connectivity and other services based on data, and enhancing software competitiveness. To do so, the company will establish specialized centers of excellence for software development in Korea and abroad.

By 2030, the company will invest a total of KRW 12 trillion to boost competitiveness in software capabilities, including KRW 4.3 trillion on technology development, such as connectivity and autonomous driving, KRW 4.8 trillion on strategic investment for startups and research institutions, and KRW 2.9 trillion on information and communications technology (ICT). After 2030, the company targets the revenue from software-related businesses to take approximately 30 percent of total sales.

Presentation scene of Gang Hyun Seo, Executive Vice President and Head of Finance & Accounting Division at Hyundai Motor Company

Financial Targets

Hyundai also disclosed mid- to long-term financial goals running through 2030, including an investment of KRW 95.5 trillion. Out of the total investment, KRW 39.1 trillion will be allocated for research and development, and KRW 43.6 trillion for capital expenditures to enhance business competitiveness, while KRW 12.8 trillion will be dedicated to strategic investment.

The KRW 95.5-trillion expenditure plan includes KRW 19.4 trillion for investment into electrification field to expand EV production capability, build charging stations and engage in strategic technology alliances.

By 2030, Hyundai aims to achieve a target of an operating profit margin of 10 percent or higher in EVs by increasing sales volume and innovating cost structure. Strengthened EV line up, development of efficient next-generation batteries as well as IMA will help the company to meet its financial goals. On a consolidated basis, the company set a goal of an operating margin of 10 percent.

As the company shared early in this year, Hyundai aims for 13~14 percent of consolidated revenue growth and 5.5~6.5 percent annual consolidated operating profit margin in 2022. The company aims for total vehicle sales of over 4.3 million units.

Hyundai Motor also strives to enhance shareholder value through a market-friendly return policy. Despite concerns over uncertainties in the business environment in 2022, the company plans to maintain its annual dividends policy at the same level as last year.

Disclaimer: Hyundai Motor Company believes the information contained herein to be accurate at the time of release. However, the company may upload new or updated information if required and assumes that it is not liable for the accuracy of any information interpreted and used by the reader.